In 2024, the Bank of Punjab (BoP) launched a 25-Year Installment Plan for property loans, aimed at aiding individuals and families in purchasing plots and houses. This comprehensive loan plan is designed to cater to the diverse financial needs of potential homeowners, offering flexible repayment options and competitive interest rates.

The Bank of Punjab’s 25-Year Installment Plan

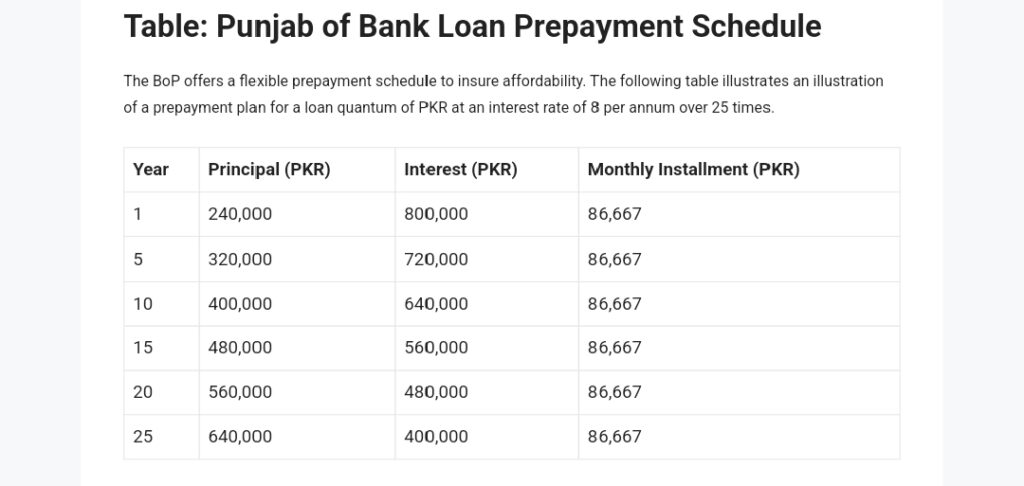

The BoP’s property loan is structured to provide financial backing to those looking to buy plots or houses, making homeownership more accessible. This loan is available for a maximum term of 25 years, ensuring that borrowers can manage their finances comfortably without feeling the burden of high monthly disbursements.

Key Features of the Bank of Punjab Property Loan-

- Loan Tenure: Up to 25 years.

- Loan Amount: Varies based on property value and applicant’s financial profile.-

- Interest Rates: Competitive and dependent on market conditions.

- Eligibility: Salaried individuals, self-employed professionals, and businessmen.

- Down Payment: Generally a minimum of 20% of the property value.

- Processing Fee Nominal charges apply.

- Insurance: Property insurance is mandatory to cover unforeseen risks.

Eligibility Criteria for the Bank of Punjab’s 25-Year Installment Plan

- To qualify for the BoP property loan, applicants must meet specific criteria:

- Age: Between 21 and 60 years.

- Income: Stable and sufficient to cover the loan disbursements.

- Credit History: Good credit score with no major defaults.-

- Employment Minimum of two years in current job or business.

Final Thoughts

The Bank of Punjab’s 25-Year Installment Plan for property loans in 2024 presents a viable opportunity for aspiring homeowners to secure their dream property without incurring financial strain. With its long term, competitive interest rates, and flexible repayment options, this loan plan is tailored to meet the needs of diverse customer segments. Whether you’re a salaried professional looking to buy your first home or a businessman aiming to invest in real estate, the BoP property loan offers a reliable and accessible financing solution.

FAQs

What is the maximum loan amount I can borrow?

The loan amount depends on your financial profile and the value of the property. Generally, BoP finances up to 80% of the property value.

Can I repay my loan before the term ends?

Yes, BoP allows early repayment of the loan. However, there may be early repayment charges applicable as per the bank’s policy.

What if I miss a monthly installment?

Missing an installment can result in late payment fees and may affect your credit score. It’s essential to communicate with BoP in case of any financial difficulties to explore possible solutions.