New Charges for Houses and Shops

Punjab’s new charges for houses and businesses are designed to raise funds for public services and infrastructure development. These taxes are part of a broader effort to enhance the quality of life for citizens while supporting the economic growth of the province. By increasing revenue from landowners, the government plans to make significant investments in roads, schools, hospitals, and other services.

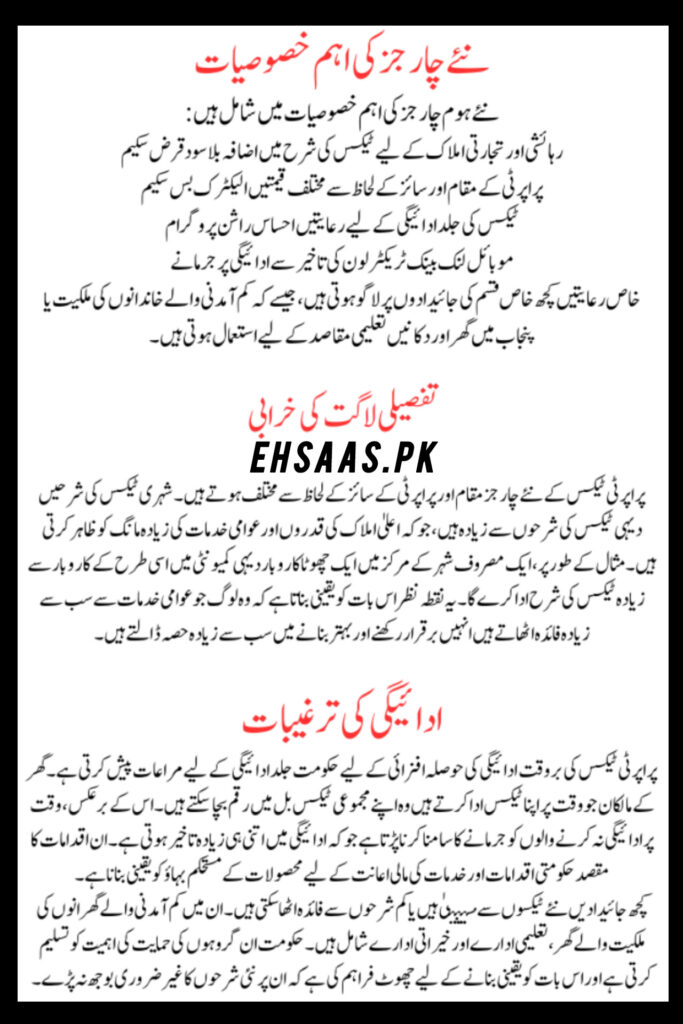

Important Features of the New Charges

The key features of the new charges include:

- 1. Increase in tax rates for residential and commercial properties

- 2. Interest-Free Loan Scheme

- 3. Variable prices based on the location and size of the property

- 4. Electric Buses Scheme

- 5. Discounts for early tax payment

- 6. Ehsaas Rashan Program

- 7. Penalties for late payment

- 8. Mobile Link Bank Tractor Loan

- 9. Exemptions for certain properties, such as those owned by low-income families or used for educational purpose

Detailed Cost Breakdown

The new property tax charges vary by location and property size. Urban tax rates are higher than rural tax rates, reflecting higher property values and greater demand for public services. For instance, a small business in a busy city center will pay a higher tax rate than a similar business in a rural community. This approach ensures that those who benefit most from public services contribute the most to maintaining and improving them.

Payment Incentives

To encourage timely payment of property taxes, the government offers incentives for early payment. Homeowners who pay their taxes on time can save money on their overall tax bill. Conversely, those who do not pay on time face penalties that increase with the delay in payment. These measures aim to ensure a steady flow of revenue to fund government initiatives and services. Certain properties are exempt from the new taxes or can benefit from reduced rates. These include homes owned by low-income households, educational institutions, and charities. The government recognizes the importance of supporting these groups and has provided exemptions to ensure they are not unduly burdened by the new rates.For more updates, visit Benazir 10500 Payment.

Impact on Residents and Businesses

The tax increase is expected to have a significant impact on Punjab residents and businesses. Homeowners may need careful financial planning to meet their obligations due to higher taxes. However, the revenue raised by these taxes will be used to improve public services and infrastructure, benefiting everyone in the long term. Enhancing roads, schools, and hospitals will improve the quality of life and drive economic growth, making Punjab a more attractive place to live and work.

Last Words

The new charges for houses and businesses in Punjab represent an important step towards improving public services and infrastructure. While homeowners may face higher taxes, everyone will benefit from improved roads, schools, and hospitals. By understanding the new taxes and planning accordingly, residents and businesses can meet their obligations and contribute to the growth and development of their communities.For more updates, visit the Ehsaas Rashan Subsidy to Sindh Balochistan pages.

Frequently Asked Questions

What are the new rates for homes and businesses in Punjab

The new charges for houses include higher property tax rates depending on location and property size, with rates higher in urban areas than rural areas.

Are there any discounts for paying taxes early?

Yes, homeowners who pay their taxes before the due date can get discounts, reducing their overall tax burden.

Who is exempt from the new taxes?

Properties owned by low-income families, properties used for educational purposes, and properties owned by charities are exempt from tax or can benefit from reduced fees.

What is the aim of the new rates?

The new charges aim to generate more revenue for public services and infrastructure development, thereby improving the quality of life and supporting economic growth in Punjab.