Punjab Bank Car Loan Scheme 2024: Transforming Vehicle Financing in Punjab

The Punjab Bank Car Loan Scheme 2024 is poised to revolutionize vehicle financing in Punjab, providing residents with affordable and accessible options for purchasing cars. This initiative aims to increase vehicle ownership, support economic growth, and enhance mobility across the region. With competitive interest rates and flexible repayment terms, the Punjab Bank Car Loan Scheme 2024 is designed to meet the diverse needs of Punjab’s residents.

Background of Car Loan Schemes

Car loans have been a crucial financial product in Punjab, enabling individuals and families to acquire vehicles without the burden of upfront costs. Over the years, various initiatives have been launched to make car loans more accessible and affordable. Previous schemes have successfully boosted vehicle ownership and stimulated the automotive market, providing valuable insights for developing the 2024 scheme.

Objectives of the Punjab Bank Car Loan Scheme 2024

The primary goals of the Punjab Bank Car Loan Scheme 2024 include:

- Providing Affordable Financing Options: Ensuring residents have access to low-interest loans for purchasing cars.

- Boosting Vehicle Ownership: Facilitating the purchase of cars to enhance personal mobility and convenience.

- Supporting Economic Growth: Stimulating the automotive market and related industries, thereby contributing to economic development.

Key Features of the Car Loan Scheme

To achieve these objectives, the scheme offers several key features:

- Competitive Interest Rates: Keeping loan costs low to make car ownership affordable.

- Flexible Repayment Terms: Offering various repayment periods to suit different financial situations.

- Minimal Processing Fees: Reducing upfront costs for borrowers to make the loan process more accessible.

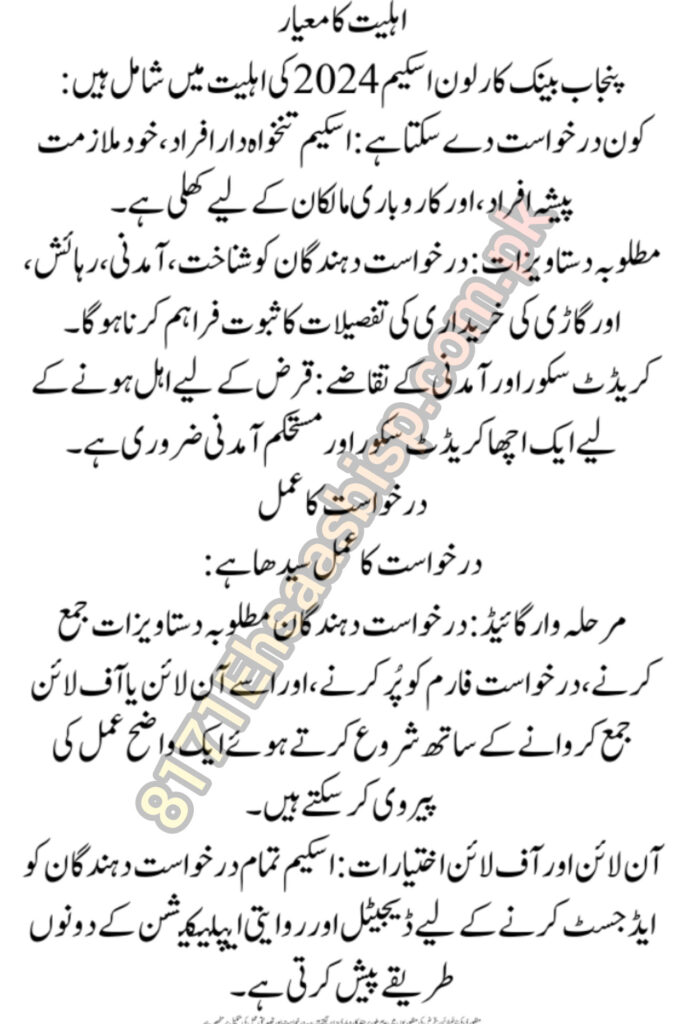

Eligibility Criteria

Eligibility for the Punjab Bank Car Loan Scheme 2024 includes:

- Who Can Apply: The scheme is open to salaried individuals, self-employed professionals, and business owners.

- Required Documentation: Applicants need to provide proof of identity, income, residence, and vehicle purchase details.

- Credit Score and Income Requirements: A good credit score and stable income are necessary to qualify for the loan.

Application Process

The application process is straightforward:

- Step-by-Step Guide: Applicants can follow a clear process, starting with gathering required documents, filling out the application form, and submitting it either online or offline.

- Online and Offline Options: The scheme offers both digital and traditional application methods to accommodate all applicants.

- Approval Timeline: Loan approvals typically take a few business days, depending on the completeness of the application and verification process.

See Also:

- Breaking News: How to Apply for the Agriculture Internship Program: A Detailed Guide 2024

- Exclusive Updates: Punjab Government Announces Major Recruitment Drive for 30,000 Teachers 2024

- Breaking News: Sindh Textbook Board Launches Ambitious Tablet Distribution Initiative for Students 2024

- ASF Jobs Apply Before August 25, 2024 – Complete Guide

- Exclusive News: Huawei Train the Trainer Program: A Groundbreaking Initiative for Pakistani Students in 2024

Loan Amount and Repayment Terms

Loan amounts and repayment terms are designed to be flexible:

- Maximum and Minimum Loan Amounts: The scheme offers loans ranging from modest amounts for used cars to higher amounts for new, premium vehicles.

- Repayment Period Options: Borrowers can choose repayment periods from 1 to 7 years, depending on their financial capacity.

- Early Repayment Benefits and Penalties: Options for early repayment are available, often with minimal penalties, encouraging borrowers to pay off their loans sooner if possible.

Interest Rates and Fees

The interest rates and fees associated with the car loan scheme are competitive:

- Interest Rate Structure: Rates are set to be affordable, varying slightly based on the applicant’s creditworthiness and loan amount.

- Additional Fees and Charges: Minimal processing fees and no hidden charges make the scheme transparent and borrower-friendly.

- Comparison with Other Schemes: The scheme is designed to offer better rates and terms than similar loan products available in the market.

Benefits of the Car Loan Scheme

The scheme offers numerous benefits:

- Financial Advantages: Affordable loans make car ownership accessible, reducing the financial burden on borrowers.

- Enhancing Mobility and Convenience: Increased vehicle ownership improves personal mobility, making daily commuting and travel more convenient.

- Stimulating the Local Economy: Higher car sales boost the automotive industry and related sectors, contributing to economic growth.

Challenges and Solutions

The scheme may face several challenges:

- Potential Obstacles: Issues such as creditworthiness of applicants, timely repayments, and economic fluctuations can pose challenges.

- Proposed Solutions: Solutions include robust credit assessments, flexible repayment plans, and targeted outreach to educate potential borrowers.

- Success Stories: Highlighting successful case studies from previous borrowers can build trust and demonstrate the scheme’s effectiveness.

Financial Aspects

Financial management is crucial for the scheme’s success:

- Funding Sources: The scheme is funded by Punjab Bank, with potential contributions from government incentives and private investors.

- Risk Management Strategies: Comprehensive risk assessment and management practices ensure the scheme’s financial stability.

- Impact on Punjab Bank’s Portfolio: The scheme is expected to positively impact the bank’s portfolio by diversifying its loan offerings and attracting new customers.

Technological Integration

Digital integration enhances the scheme’s efficiency:

- Role of Digital Platforms: Online applications, loan tracking, and digital customer support streamline the loan process.

- Online Application and Tracking Tools: Borrowers can apply for loans and track their status through Punjab Bank’s digital platforms.

- Customer Support: Digital channels provide 24/7 customer support, offering assistance and information to applicants.

Case Studies

Real-life examples underscore the scheme’s benefits:

- Success Stories from Past Beneficiaries: Highlighting individual stories of borrowers who successfully used the loan scheme can inspire confidence.

- Impact on Different Demographics: Showcasing how the scheme has helped various demographics, from young professionals to families, demonstrates its wide-reaching benefits.

- Lessons Learned and Best Practices: Insights from past implementations help refine the scheme and improve future iterations.

Government and Policy Support

Government involvement is crucial:

- Role of the Government: Supporting the scheme through policy measures, incentives, and regulatory frameworks ensures its success.

- Key Policy Measures: Policies that promote affordable car loans, encourage vehicle purchases, and support the automotive industry are essential.

- Future Policy Directions: Continuous improvement and adaptation of policies to meet evolving market needs will sustain the scheme’s effectiveness.

Future Prospects

The scheme’s long-term vision is promising:

- Long-term Vision: Aiming to make car ownership widely accessible, thereby improving the quality of life and economic opportunities in Punjab.

- Expansion Plans: Potential expansion to include more flexible financing options and broader eligibility criteria.

- Potential Impact: The scheme could significantly impact Punjab’s transportation landscape, increasing vehicle ownership and mobility.

Conclusion

The Punjab Bank Car Loan Scheme 2024 is a transformative initiative designed to make car ownership more accessible and affordable. By offering competitive interest rates, flexible repayment terms, and minimal fees, the scheme addresses the needs of Punjab’s residents. Continued support from the government, private sector, and community will be crucial for the scheme’s success, paving the way for a more mobile and economically vibrant Punjab.

FAQs

What is the Punjab Bank Car Loan Scheme 2024?

The Punjab Bank Car Loan Scheme 2024 is a financial initiative designed to provide affordable car loans to residents, promoting vehicle ownership and supporting economic growth.

Who can apply for the scheme?

The scheme is open to salaried individuals, self-employed professionals, and business owners with a good credit score and stable income.

What are the benefits of the scheme?

The scheme offers affordable financing, flexible repayment terms, and minimal fees, making car ownership accessible and stimulating economic growth.

How can one apply for the loan?

Applicants can apply online or offline by submitting the required documents and following the straightforward application process outlined by Punjab Bank.

What are the repayment options?

Borrowers can choose repayment periods ranging from 1 to 7 years, with options for early repayment available.